Tax Depreciation Life For Vehicles . The total section 179 deduction and depreciation you can. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. depreciation limits on business vehicles. Macrs (declining balance method) and. irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. in general, there are two primary methods for calculating vehicle depreciation for taxes:

from www.bartleby.com

depreciation limits on business vehicles. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. The total section 179 deduction and depreciation you can. irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. Macrs (declining balance method) and. in general, there are two primary methods for calculating vehicle depreciation for taxes:

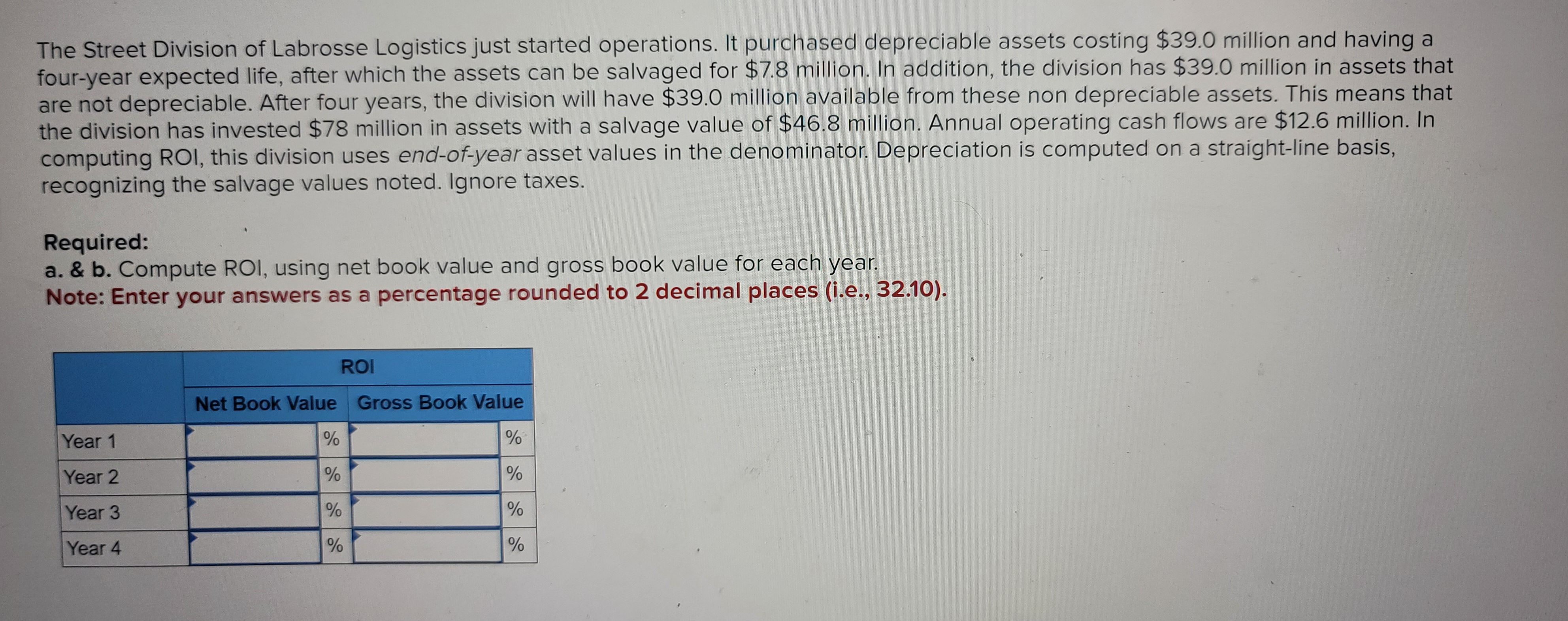

Answered The Street Division of Labrosse… bartleby

Tax Depreciation Life For Vehicles depreciation limits on business vehicles. Macrs (declining balance method) and. if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. depreciation limits on business vehicles. in general, there are two primary methods for calculating vehicle depreciation for taxes: The total section 179 deduction and depreciation you can.

From exornobqm.blob.core.windows.net

Depreciation Rate Office Desk at Ann Chan blog Tax Depreciation Life For Vehicles irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. depreciation limits on business vehicles. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. The total section 179 deduction and depreciation you can. Macrs (declining balance method) and. if business vehicles are passenger automobiles, they. Tax Depreciation Life For Vehicles.

From www.solutionspile.com

[Solved] a 7 recovery period asset for tax purposes. 31 Ne Tax Depreciation Life For Vehicles in general, there are two primary methods for calculating vehicle depreciation for taxes: if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. Macrs (declining balance method) and. . Tax Depreciation Life For Vehicles.

From dxoaerbpc.blob.core.windows.net

Standard Depreciation Rate For Office Equipment at Peggy Nisbet blog Tax Depreciation Life For Vehicles The total section 179 deduction and depreciation you can. Macrs (declining balance method) and. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. depreciation limits on business vehicles. if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted. Tax Depreciation Life For Vehicles.

From kainanrikki.blogspot.com

Special depreciation allowance calculator KainanRikki Tax Depreciation Life For Vehicles Macrs (declining balance method) and. in general, there are two primary methods for calculating vehicle depreciation for taxes: depreciation limits on business vehicles. The total section 179 deduction and depreciation you can. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. irs tax topic on deductible car expenses such. Tax Depreciation Life For Vehicles.

From dxofcccha.blob.core.windows.net

Equipment Life For Depreciation at Mary Rivera blog Tax Depreciation Life For Vehicles The total section 179 deduction and depreciation you can. depreciation limits on business vehicles. irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. if business vehicles are passenger automobiles, they are listed property and are. Tax Depreciation Life For Vehicles.

From exocoyzqy.blob.core.windows.net

Vehicles Eligible For Bonus Depreciation at Gordon Maxwell blog Tax Depreciation Life For Vehicles if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. Macrs (declining balance method) and. depreciation limits on business vehicles. in general, there are two primary methods for calculating vehicle depreciation for taxes: depreciation of passenger vehicles for tax purposes can be. Tax Depreciation Life For Vehicles.

From www.coursehero.com

[Solved] A machine costing 214,000 with a fouryear life and an Tax Depreciation Life For Vehicles irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. The total section 179 deduction and depreciation you can. Macrs (declining balance method) and. if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. depreciation of passenger vehicles for. Tax Depreciation Life For Vehicles.

From www.bartleby.com

Answered The Street Division of Labrosse… bartleby Tax Depreciation Life For Vehicles in general, there are two primary methods for calculating vehicle depreciation for taxes: The total section 179 deduction and depreciation you can. depreciation limits on business vehicles. Macrs (declining balance method) and. if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. . Tax Depreciation Life For Vehicles.

From exojbdncg.blob.core.windows.net

Depreciable Life For Machinery And Equipment at Rhonda McClain blog Tax Depreciation Life For Vehicles Macrs (declining balance method) and. irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. in general, there are two primary methods for calculating vehicle depreciation for taxes: depreciation limits on business vehicles. if business. Tax Depreciation Life For Vehicles.

From printablemediaells.z21.web.core.windows.net

Depreciation Worksheet Excel Template Tax Depreciation Life For Vehicles The total section 179 deduction and depreciation you can. depreciation limits on business vehicles. in general, there are two primary methods for calculating vehicle depreciation for taxes: if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. Macrs (declining balance method) and. . Tax Depreciation Life For Vehicles.

From www.bartleby.com

Answered The Street Division of Labrosse… bartleby Tax Depreciation Life For Vehicles in general, there are two primary methods for calculating vehicle depreciation for taxes: if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. irs tax topic. Tax Depreciation Life For Vehicles.

From daciayhoratia.pages.dev

2024 Bonus Depreciation Amount For Vehicles Robin Christin Tax Depreciation Life For Vehicles Macrs (declining balance method) and. depreciation limits on business vehicles. The total section 179 deduction and depreciation you can. if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements.. Tax Depreciation Life For Vehicles.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Tax Depreciation Life For Vehicles Macrs (declining balance method) and. if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. depreciation limits on business vehicles. The total section 179 deduction and depreciation you can. in general, there are two primary methods for calculating vehicle depreciation for taxes: . Tax Depreciation Life For Vehicles.

From exocoyzqy.blob.core.windows.net

Vehicles Eligible For Bonus Depreciation at Gordon Maxwell blog Tax Depreciation Life For Vehicles if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. The total section 179 deduction and depreciation you can. depreciation limits on business vehicles. in general, there are two primary methods for calculating vehicle depreciation for taxes: depreciation of passenger vehicles for. Tax Depreciation Life For Vehicles.

From dxoloqxfn.blob.core.windows.net

Real Estate Depreciation Life at Donald Smith blog Tax Depreciation Life For Vehicles Macrs (declining balance method) and. The total section 179 deduction and depreciation you can. depreciation limits on business vehicles. in general, there are two primary methods for calculating vehicle depreciation for taxes: depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. irs tax topic on deductible car expenses such. Tax Depreciation Life For Vehicles.

From www.calt.iastate.edu

Using Percentage Tables to Calculate Depreciation Center for Tax Depreciation Life For Vehicles in general, there are two primary methods for calculating vehicle depreciation for taxes: Macrs (declining balance method) and. depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. depreciation limits on business vehicles. if business vehicles are passenger automobiles, they are listed property and are subject to limits on the. Tax Depreciation Life For Vehicles.

From gioppnlpv.blob.core.windows.net

Construction Equipment Depreciation Life Irs at Ronald Garrison blog Tax Depreciation Life For Vehicles depreciation limits on business vehicles. The total section 179 deduction and depreciation you can. in general, there are two primary methods for calculating vehicle depreciation for taxes: if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. Macrs (declining balance method) and. . Tax Depreciation Life For Vehicles.

From mromavolley.com

Flooring Depreciation Life Irs Floor Roma Tax Depreciation Life For Vehicles if business vehicles are passenger automobiles, they are listed property and are subject to limits on the amount that can be deducted for regular. depreciation limits on business vehicles. in general, there are two primary methods for calculating vehicle depreciation for taxes: Macrs (declining balance method) and. The total section 179 deduction and depreciation you can. . Tax Depreciation Life For Vehicles.